Income tax marginal rates 2021

Stylized Marginal and Average Income Tax Rates. Your Federal taxes are estimated at 0.

Corporate Income Taxes In Canada Revenue Rates And Rationale Hillnotes

Many states do not release their current-tax-year 2021 brackets until the.

. 2019 tax year 1 March 2018 28 February 2019 Taxable income R Rates of tax R 1 195 850. Discover Helpful Information And Resources On Taxes From AARP. However as they are every year the 2022 tax.

Ad Compare Your 2022 Tax Bracket vs. If you are single and your taxable income is 75000 in 2022 your marginal tax bracket is 22. The federal tax brackets and rates are different marginal tax rates charged across the seven tax brackets.

Foreign resident tax rates 202122. How Do Marginal Income Tax Rates Work in 2021. At the same time cities and counties may impose their own occupational taxes.

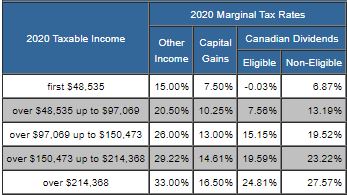

Examples below use marginal tax rates in effect in 2021 ie associated with 2021 income tax returns generally filed in 2022. Office of Tax Analysis. The Federal Income Tax is a marginal income tax collected by the Internal Revenue Service IRS on most types of personal and business income.

However some of your income will be taxed at the lower tax brackets 10. The federal income tax consists of six. For 2018 and previous tax years you can find the federal.

This includes income from self-employment or renting out property and some overseas income. Your income puts you in the 10 tax. They are provided and updated by the International Revenue.

All of our bracket data and tax rates are updated yearly from the IRS and state revenue departments. 10 12 22 24 32 35 and 37. October 26 2021.

195 851 305 850. And Tax Support for Families under the American Rescue Plan. You pay tax on this income at the end of the tax year.

35 253 26 of taxable. Tax Year 2021. That rate ranks slightly below the national average.

The In Focus examines the mechanics of statutory marginal. The amount of tax you pay depends on. 39000 plus 37 cents for each 1 over 120000.

Ad Compare Your 2022 Tax Bracket vs. We provide a one-stop resource for finding state and federal tax information including income sales and property tax rates. Tax on this income.

To find income tax rates for previous years see the Income Tax Package for that year. Your tax bracket depends on your taxable income. 325 cents for each 1.

Tax rates for previous years 1985 to 2021. 18 of taxable income. Your 2021 Tax Bracket To See Whats Been Adjusted.

Kentucky has a flat income tax of 5. 0 would also be your average tax. There are seven tax brackets for most ordinary income for the 2021 tax year.

This is 0 of your total income of 0.

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Personal Income Tax Brackets Ontario 2019 Md Tax

Taxtips Ca Manitoba 2021 2022 Personal Income Tax Rates

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Personal Income Tax Brackets Ontario 2021 Md Tax

Taxtips Ca Federal 2019 2020 Income Tax Rates

Personal Income Tax Brackets Ontario 2020 Md Tax

Winter 2021 Canadian Income Tax Highlights Cardinal Point Wealth Management

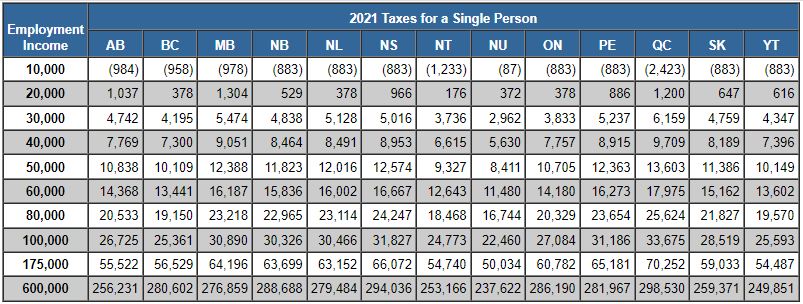

Taxtips Ca 2021 Tax Comparison Employment Income

Corporate Income Taxes In Canada Revenue Rates And Rationale Hillnotes

Marginal Tax Rates How To Calculate Ontario Income Tax Kalfa Law

Manitoba Tax Brackets 2020 Learn The Benefits And Credits

Taxtips Ca Personal Income Tax Rates For Canada Provinces Territories

Tax Brackets Canada 2022 Filing Taxes

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

State Corporate Income Tax Rates And Brackets Tax Foundation

Yemen Personal Income Tax Rate 2022 Data 2023 Forecast 2004 2021 Historical